Clinical Labs Records Sixth Straight Quarterly Revenue Gain on Growing Molecular Diagnostics Volume

New York State Approvals of New Molecular Diagnostic Assays Highlight R&D Activity

NEW YORK, NY, June 8, 2017 – Enzo Biochem Inc. (NYSE:ENZ) today announced growth in operating results for the third fiscal quarter and nine months ended April 30, 2017.

Third Quarter Highlights

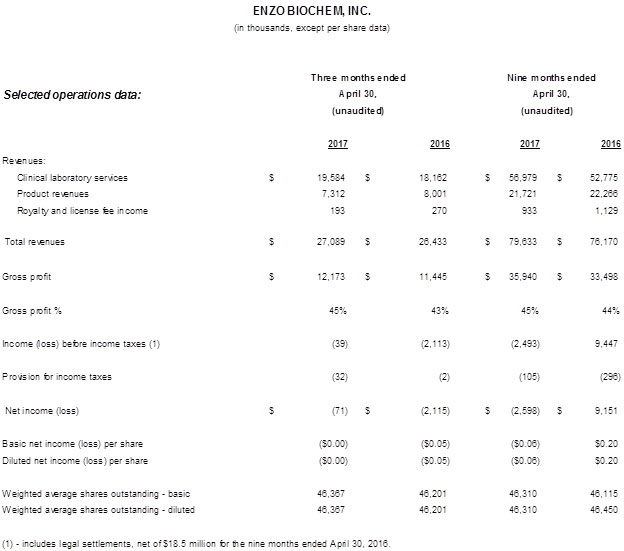

- Total revenues increased to $27.1 million, a 2% increase from $26.4 million in the prior year period.

- Clinical Labs revenues totaled $19.6 million, an 8% increase over the prior year period and the sixth straight quarterly increase, reflecting continued growth in volume of high margin molecular diagnostic tests (MDx). Gross margins advanced 300 basis points, to 42%.

- Consolidated gross margin was 45%, a 200 basis points improvement over the prior year period.

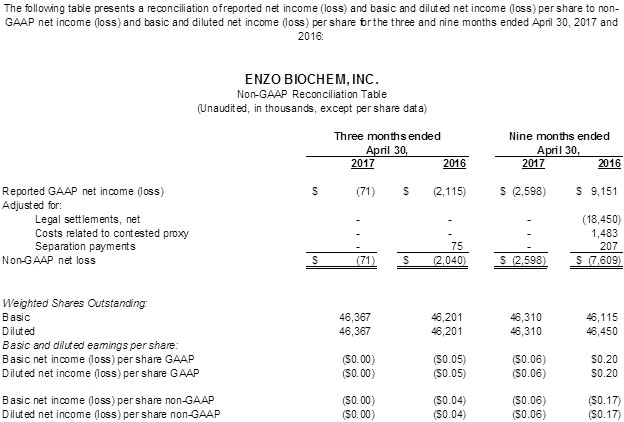

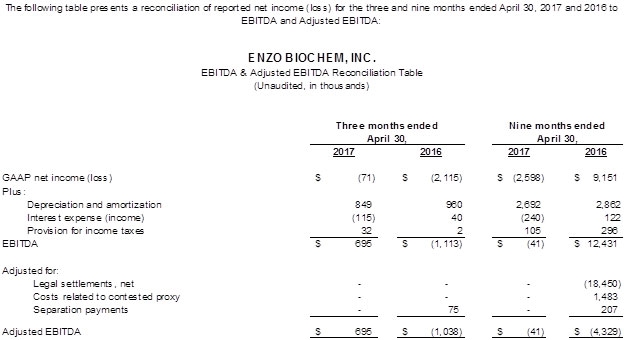

- With operating expenses lower, including legal costs, Enzo recorded a GAAP loss of $71,000, or $0.00 per share. EBITDA, a non-GAAP measure, was $0.7 million, a $1.8 million improvement over the prior year period.

- Enzo Life Sciences’ revenue was $7.5 million, an 9% decline from $8.3 million in the prior year period. This was due to timing of product shipments, continued reduction in the product mix to emphasize higher margins, and industrywide weakness in the academic and governmental markets. Despite reduced revenues, the segment remained profitable and cash flow positive.

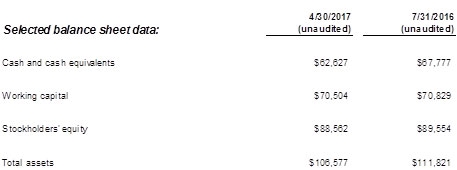

- Consolidated cash flows from operations in the quarter were $0.9 million. After investing $0.7 million in capital expenditures related to expansion in the Clinical Labs, total cash and cash equivalents increased $0.2 million over the second fiscal quarter 2017. Working capital at April 30, 2017 was in excess of $70.5 million.

- As previously announced, New York State Department of Health’s recent conditional approval of three new diagnostics for the company’s cost efficient AmpiProbe® PCR platform paves the way for their additions to Enzo’s expected specialized 14-analyte panel, anticipated to be available by fall, that will further establish Enzo’s strong MDx position in women’s health.

Barry Weiner, President, Comments:

“This was another excellent quarter of operational performance, one of sustained growth, technological advances and market inroads. Our transformative strategy to a fully integrated molecular diagnostic company is being recognized in the marketplace. The quarter was notable for the steadily increasing performance of our clinical services. It reflected the addition of new clients, growing interest in our molecular diagnostic development capabilities, and expanding national reference services giving recognition of our leading position as a provider of comprehensive women’s health diagnostics. Enzo Life Sciences was affected by timing of certain U.S. shipments, and tightening of academic and government spending, while the segment focuses on product development and approvals. In a relatively short time, we have streamlined its product mix to concentrate on higher margin products and have reduced products by over one-third to free capacity for molecular diagnostics manufacturing and distribution. At the same time, Enzo Life Science’s research capabilities, uniquely integrated with our Clinical Labs, continues to turn out advanced genomic diagnostic products built around our proprietary technology platforms. This has enabled gross margin expansion at Enzo and broadens our MDx test menu that offers greater efficiency and reduced costs to independent laboratory customers.

“The integration of our operations is proving an important aspect of our activities. We have been able to build a formidable business model employing our significant patent estate and years of accumulated know-how to benefit today’s independent lab market. Specifically, we now provide a growing menu of highly efficient, versatile and cost effective MDx products and platforms, compatible with current open systems, which could result in significant savings -- in many cases between 30% to 50%. We also have gone a step further by making our state-of-the-art lab capabilities available on a reference basis, enabling many independent labs to utilize our services to continue to respond to their client-physician needs and maintain margins as one effective way for dealing with high product costs and shrinking reimbursements.

“Also, Enzo was recently designated as an in-network health care provider in the U.S. by one of the nation’s leading health services organizations. Expanding Enzo’s in-network insurance coverage nationwide is a key component of our growth strategy.

“Lastly, our patent infringement related lawsuits are moving through the court system in Delaware and we expect some trials may get underway before the end of the year.”

Fiscal 2017 Third Quarter Consolidated Operating Results

During the quarter, revenues were $27.1 million compared to $26.4 million a year ago, an increase of $0.7 million or 2%. Gross profit improved to $12.2 million, from $11.4 million a year ago, with consolidated gross margin of 45%, an increase of 200 basis points, principally due to growth in the clinical services. Operating expenses were $12.4 million, down from $14.0 million in the prior year period, mainly due to lower legal and SG&A expenses. Operating loss improved $2.3 million, to ($0.2) million, compared to an operating loss a year ago of ($2.5) million.

The Company reported a net loss of less than ($0.1) million, compared to a year ago net loss of ($2.1) million. Basic and fully diluted per share results were ($0.00) compared to ($0.05) a year ago. Earnings before interest, depreciation and amortization (EBITDA), a non-GAAP measure, was $0.7 million, compared to negative EBITDA a year ago of ($1.1) million.

As of April 30, 2017, cash and cash equivalents and working capital were $62.6 million and $70.5 million, respectively.

Segment Quarterly Results

Enzo Clinical Labs reported revenues of $19.6 million compared to $18.2 million a year ago, an increase of $1.4 million or 8%. Molecular testing continues to grow, as well as new accounts added beyond existing regional areas, especially in the women’s health segment where Enzo has increased its market share in the New York metropolitan area. Gross profit was $8.3 million, with gross margin of 42%, up 300 basis points from the prior year. Total operating expenses were $6.8 million compared to $6.7 million in the prior year. Operating income amounted to $1.5 million, compared to $0.3 million a year ago, a five-fold increase.

Enzo Life Sciences revenues were $7.5 million compared to $8.3 million in the prior year period, a decrease of $0.8 million or 9%, due to lower product sales resulting from timing of certain U.S. shipments that are expected to be picked up in subsequent quarters, as well as continued weakness in the academic and industrial markets due to reduced funding, amid industry pricing pressures. Gross profit was $3.9 million with gross margin of 52%. Operating income was $0.6 million, a decrease from $0.9 million a year ago.

Fiscal 2017 Nine Months Consolidated Operating Results

Year to date revenues increased to $79.6 million compared to $76.2 million from a year ago, an increase of $3.5 million or 5%. Gross profit increased 7% to $35.9 million and gross margin increased 100 basis points to 45%. Operating expenses were $38.4 million compared to $42.4 million before licensing and legal settlements, a decrease of $3.9 million or 9%, principally due to lower legal fees offset in part by higher SG&A costs.

Year to date net loss was ($2.6) million compared to a year ago net income of $9.1 million, which included $18.5 million in licensing and legal settlements. Basic and fully diluted per share loss equaled ($0.06), versus per share income of $0.20 last year.

Conference Call

The Company will conduct a conference call Friday, June 9, 2017 at 8:30 AM ET. The call can be accessed by dialing 1-888-459-5609. International callers can dial 1-973-321-1024. Please reference PIN number 34280145. Interested parties may also listen over the Internet at http://tinyurl.com/h5vvpm4 To listen to the live call on the Internet, please go to the web site at least fifteen minutes early to register, download and install any necessary audio software. For those who cannot listen to the live broadcast, a replay will be available approximately two hours after the end of the live call, through midnight (ET) on Friday, June 30, 2017. The replay of the conference call can be accessed by dialing 1-800-585-8367, and when prompted, use PIN number 34280145. International callers can dial 1-404-537-3406, using the same PIN number.

NON-GAAP Financial Measures

To comply with Regulation G promulgated pursuant to the Sarbanes-Oxley Act, Enzo Biochem attached to this news release and will post to the Company's investor relations web site (www.enzo.com) any reconciliation of differences between non-GAAP financial information that may be required in connection with issuing the Company's quarterly financial results.

The Company uses EBITDA as a measure of performance to demonstrate earnings exclusive of interest, taxes, depreciation and amortization. Adjustments to EBITDA are for items of a non-recurring nature and are reconciled on the table provided. The Company manages its business based on its operating cash flows. The Company, in its daily management of its business affairs and analysis of its monthly, quarterly and annual performance, makes its decisions based on cash flows, not on the amortization of assets obtained through historical activities. The Company, in managing its current and future affairs, cannot affect the amortization of the intangible assets to any material degree, and therefore uses EBITDA as its primary management guide. Since an outside investor may base its evaluation of the Company's performance based on the Company's net loss not its cash flows, there is a limitation to the EBITDA measurement. EBITDA is not, and should not be considered, an alternative to net loss, loss from operations, or any other measure for determining operating performance of liquidity, as determined under accounting principles generally accepted in the United States (GAAP). The most directly comparable GAAP reference in the Company's case is the removal of interest, taxes, depreciation and amortization.

We refer you to the tables attached to this press release which includes reconciliation tables of GAAP to Non-GAAP net income (loss) and EBITDA to Adjusted EBITDA.

About Enzo Biochem

Enzo Biochem is a pioneer in molecular diagnostics, leading the convergence of clinical laboratories, life sciences and intellectual property through the development of unique diagnostic platform technologies that provide numerous advantages over previous standards. A global company, Enzo Biochem utilizes cross-functional teams to develop and deploy products, systems and services that meet the ever-changing and rapidly growing needs of health care today and into the future. Underpinning Enzo Biochem’s products and technologies is a broad and deep intellectual property portfolio, with patent coverage across a number of key enabling technologies.

Except for historical information, the matters discussed in this news release may be considered "forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include declarations regarding the intent, belief or current expectations of the Company and its management, including those related to cash flow, gross margins, revenues, and expenses which are dependent on a number of factors outside of the control of the Company including, inter alia, the markets for the Company’s products and services, costs of goods and services, other expenses, government regulations, litigation, and general business conditions. See Risk Factors in the Company’s Form 10-K for the fiscal year ended July 31, 2016. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties that could materially affect actual results. The Company disclaims any obligations to update any forward-looking statement as a result of developments occurring after the date of this press release.

Contact:

For: Enzo Biochem, Inc.

Steve Anreder, 212-532-3232 or Michael Wachs, CEOcast, Inc., 212-732-4300

steven.anreder@anreder.com mwachs@ceocast.com