NEW YORK, NY, March 11, 2014-- Enzo Biochem Inc. (NYSE:ENZ) today reported across-the-board improved results for the fiscal second quarter ended January 31, 2014 as compared to the corresponding year-ago period.

- Total revenues improved 3%, with gains in Life Science and Clinical Labs, despite inclement winter weather that impacted laboratory revenues.

- Enzo Life Sciences operating results showed benefits of strategic realignment, including its emphasis on targeted markets with higher margin products.

- Enzo Clinical Labs posted operating gains as a result of its emphasis on greater number of high-value assays and new alliances, as well as reduced accounts receivables uncollectible provisions from better collection experience. New alliances are expanding Clinical Labs’ range of esoteric and molecular diagnostics, particularly in women’s health area, a growing specialty for Enzo.

- Gross margin increased by 13%, with both Life Sciences and Enzo Clinical Labs segments growing by double-digits.

- Total operating expenses were reduced by 6%, due to across the board expense reductions.

- Net loss improved by $2.1 million, declining 37%, while EBITDA loss fell by 46%.

- Cash was essentially unchanged from the prior quarter ended October 31, 2013.

“Enzo Biochem’s second fiscal quarter displayed strong resiliency and growth,” said Barry Weiner, President. “The overall improvement was achieved despite the continuing challenges in healthcare, the cross winds in the regulatory sector that continue to buffet our industry and adverse weather that reduced patient volume. In particular, weather in the second quarter probably cost Clinical Labs in excess of $500,000 in revenue. Nonetheless, the transformation of Enzo continues, as we increasingly and successfully reposition Life Sciences utilizing more focused marketing programs directed at higher margin products, and as our Clinical Labs enjoys and benefits from greater recognition from a growing roster of women’s health and other diagnostics tests, along with heightened efficiency at both units. Our AmpiProbe™ platform is being designed to provide a next-generation of molecular-based diagnostics that can impart higher sensitivity at lower cost than currently available assays.

Our attention is on continuing to expand service and product offerings, reducing operating expenses, while expanding on our many strengths and focusing on new opportunities. On the legal front, we are moving forward, with two trials slated for New York federal district court this spring, actions in Wilmington, Delaware moving forward and addressing the appeal by the defendants regarding the $61 million-plus judgment we were awarded in New Haven, Connecticut. We believe these near-term outcomes could further validate the value of our intellectual property portfolio and serve as a catalyst for opportunities to monetize our IP. This is shaping up as a watershed year for Enzo, and we are confident regarding the outlook.”

Second Fiscal Quarter Results

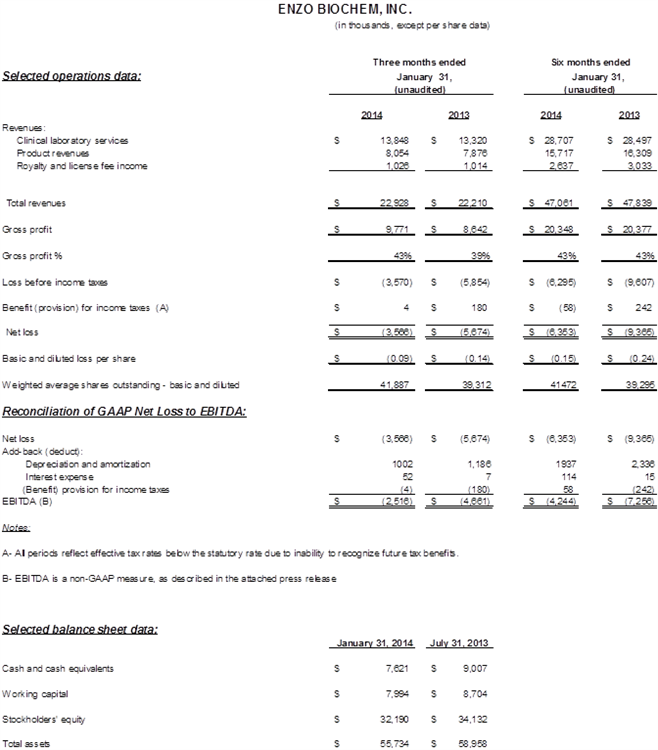

Despite the aforementioned weather effect, total revenues increased 3%, to $22.9 million, compared to $22.2 million in the prior year period with positive results in all segments. Gross profit as a percent of revenues was up 13%, to 43% from 39%, as a result of service and product revenue with higher margins and incremental manufacturing efficiencies. Other operating expenses declined to $13.3 million from $14.6 million, a decrease of $1.3 million or 9% on lower research and development costs, SG&A spending and lower provisions for uncollectible accounts receivable. The net loss in the current year period declined to ($3.6) million, or ($0.09) per share, from ($5.7) million, or ($0.14) per share in the prior year period, an improvement of $2.1 million, or 37%. EBITDA loss (earnings/loss before interest, taxes, depreciation and amortization), a non-GAAP measure, improved by $2.1 million, to ($2.5) million.

Segment Results

Unless otherwise indicated, results are for the second quarter ended January 31, 2014, compared to the same prior year period.

The redirection initiated roughly a year ago of Enzo Life Sciences towards higher end products with wider product margins, and a strategic marketing approach resulted in second fiscal 2014 quarter top line growth after several down quarters due to the changed product mix. While academia and other government funded research continued to be weak, the results of our strategy was evident in Enzo product revenues increasing to $8.1 million, compared to $7.9 million in the prior year period. Despite the higher revenues, cost of goods declined to $3.9 million, from $4.1 million. As a percentage of revenues, gross margins were 57%, compared to 53%, a 400 basis point improvement. Other operating expenses were $3.9 million compared to $4.8 million in the prior year period, an improvement of $0.9 million or 19%. As a result of these efforts, Life Sciences had operating income of $1.3 million compared to breakeven results in the prior year period.

At Enzo Clinical Labs, recent severe winter weather curtailed physician visits and reduced specimen counts. However, the Labs results were comfortably above year ago levels reflecting in part higher revenue from the new test offerings. Revenues were $13.8 million, compared to $13.3 million in the prior year period, an increase of $0.5 million or 4% despite the weather’s impact that resulted in more than $500,000 in lost revenues With decreases in costs and supplies, cost of goods declined to $9.3 million from $9.4 million, a decrease of 1%. As a percentage of revenues, gross profit increased by 400 basis points to 33%. Benefiting as well from the reduced provision for uncollectible accounts receivables, the Lab reported an operating loss of $1.5 million compared to $2.4 million, an improvement of $0.9 million, or 38%.

First Half Fiscal 2014 Results

First half revenues in the current year period amounted to $47.0 million, compared with $47.8 million in the prior year period, a decline of $0.8 million or 2%. Enzo Clinical Lab revenue was higher over the prior year period, but Life Sciences revenue was slightly lower due to both market softness and the realignment program to focus on higher margin products. Gross margin, as a percentage of revenues, remained constant with lower reported revenues. Other operating expenses declined to $26.9 million from $30.3 million, a decrease of $3.4 million or more than 11% on reduced SG&A expenses and lower provisions for uncollectible accounts receivables. The net loss for the six months was ($6.4) million, or ($0.15) per share, compared to ($9.4) million, or ($0.24) per share, an improvement over the prior year period of $3.0 million, or 32%. As a result, EBITDA loss improved by $3.1 million, to ($4.2) million.

As of January 31, 2014, current assets of $30.6 million, included $7.6 million in cash and cash equivalents, compared with current liabilities of $22.6 million. Working capital amounted to $8.0 million. The Cash and working capital amounts are essentially unchanged from the prior quarter end at October 31, 2013.

President’s Comments

Mr. Weiner added: “Our progress is underscored by the attention Enzo Clinical Labs is attracting for its strategic and strong position in one of the key medical markets in the country, with an increasing number of companies developing new molecular diagnostic and other approaches partnering with us in introducing their path breaking tests to physicians. To illustrate, we recently entered into a non-exclusive distribution agreement to market a non-invasive HER-2/neu serum test, a key assay in the monitoring of metastatic breast cancer. Esoteric testing is rapidly becoming a growing specialty, as is our extensive panel of diagnostics afforded to women’s health. In another alliance, we have entered into a joint effort involving pharmaceutical clients that ultimately could result in tissue-based companion diagnostics enabling personalized diagnosis and treatment of disease with a major impact on drug development. These activities are in addition to our own development program at Enzo Life Sciences, where we are focused on extending our highly valued patent estate with new approaches built upon our long successful history of product development, while we also continue to explore new opportunities to maximize the value of our broad and proven capabilities.”

Conference Call

The Company will conduct a conference call Wednesday March 12, 2014 at 8:30 AM ET. The call can be accessed by dialing 1-888-459-5609. International callers can dial 1-973-321-1024. Please reference PIN number 10213172. Interested parties may also listen over the Internet at http://phoenix.corporate-ir.net/phoenix.zhtml?p=irol-eventDetails&c=94391&eventID=5114961 To listen to the live call on the Internet, please go to the web site at least fifteen minutes early to register, download and install any necessary audio software. For those who cannot listen to the live broadcast, a replay will be available approximately two hours after the end of the live call, through midnight (ET) on March 26, 2014. The replay of the conference call can be accessed by dialing 1-800-585-8367, and when prompted, use PIN number 10213172. International callers can dial 1-404-537-3406, using the same PIN number.

NON-GAAP Financial Measures

To comply with Regulation G promulgated pursuant to the Sarbanes-Oxley Act, Enzo Biochem attached to this news release and will post to the Company's investor relations web site (www.enzo.com) any reconciliation of differences between non-GAAP financial information that may be required in connection with issuing the Company's quarterly financial results.

The Company uses EBITDA, as a measure of performance to demonstrate earnings exclusive of interest, taxes, depreciation and amortization. Adjustments to EBITDA are for items of a non-recurring nature and are reconciled on the table provided. The Company manages its business based on its operating cash flows. The Company, in its daily management of its business affairs and analysis of its monthly, quarterly and annual performance, makes its decisions based on cash flows, not on the amortization of assets obtained through historical activities. The Company, in managing its current and future affairs, cannot affect the amortization of the intangible assets to any material degree, and therefore uses EBITDA as its primary management guide. Since an outside investor may base its evaluation of the Company's performance based on the Company's net loss not its cash flows, there is a limitation to the EBITDA measurement. EBITDA is not, and should not be considered, an alternative to net loss, loss from operations, or any other measure for determining operating performance of liquidity, as determined under accounting principles generally accepted in the United States (GAAP). The most directly comparable GAAP reference in the Company's case is the removal of interest, taxes, depreciation and amortization.

About Enzo Biochem

Enzo Biochem is a pioneer in molecular diagnostics, leading the convergence of clinical laboratories, life sciences and therapeutics through the development of unique diagnostic platform technologies that provide numerous advantages over previous standards. A global company, Enzo Biochem utilizes cross-functional teams to develop and deploy products systems and services that meet the ever-changing and rapidly growing needs of health care both today and into the future. Underpinning Enzo Biochem’s products and technologies is a broad and deep intellectual property portfolio, with patent coverage across a number of key enabling technologies.

Except for historical information, the matters discussed in this news release may be considered "forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include declarations regarding the intent, belief or current expectations of the Company and its management, including those related to cash flow, gross margins, revenues, and expenses are dependent on a number of factors outside of the control of the company including, inter alia, the markets for the Company’s products and services, costs of goods and services, other expenses, government regulations, litigations, and general business conditions. See Risk Factors in the Company’s Form 10-K for the fiscal year ended July 31, 2013. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties that could materially affect actual results. The Company disclaims any obligations to update any forward-looking statement as a result of developments occurring after the date of this press release.

###

Contact:

For Enzo Biochem, Inc.

Steven Anreder Michael Wachs

Anreder & Company CEOcast, Inc.

212-532-3232 212-732-4300

steven.anreder@anreder.com or mwachs@ceocast.com

Table Follows