Second Fiscal Quarter Results

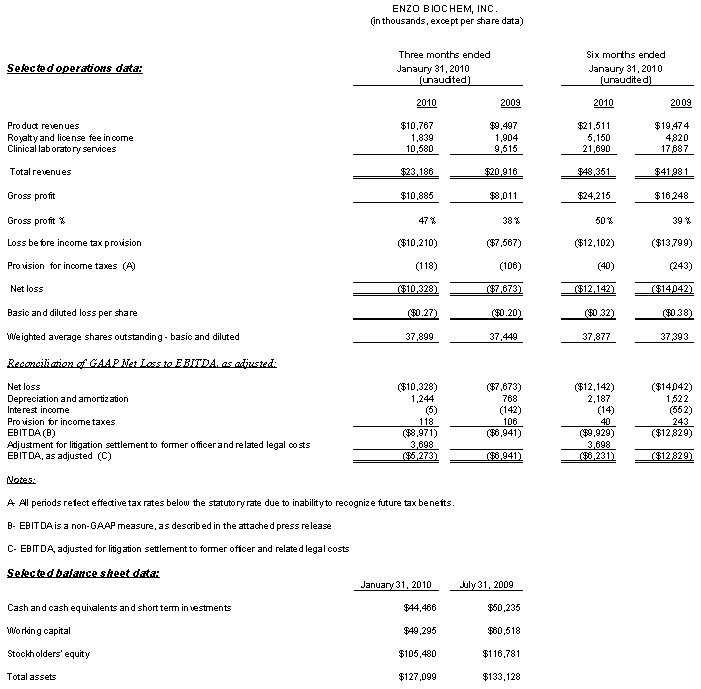

- Total operating revenue increased 11% year-over-year to $23.2 million, with both operating units – Enzo Clinical Labs and Enzo Life Sciences – contributing to the gain.

- Gross profit advanced 36%, to $10.9 million; gross margin increased 24% from 38% in the year ago quarter to 47% in this year’s quarter.

- EBITDA, a non-GAAP measure, as adjusted for settlement of litigation with a former officer and related legal costs aggregating $3.7 million, improved $1.6 million, from a loss of ($6.9) million in the year-earlier period to a loss of ($5.3) million in the current quarter. The improvement reflected increased operating income at Enzo Life Sciences and a reduced operating loss at Enzo Clinical Labs. EBITDA, as adjusted improved, despite incremental proxy related fees and expenses of $0.7 million.

- Including the charges discussed previously, the three-month net loss, including charges discussed above, totaled ($10.3) million, or ($0.27) per basic and diluted shares, compared with the year ago net loss of ($7.7) million, or ($0.20) per basic and diluted shares.

- As of January 31, 2010, working capital amounted to $49.3 million. Cash and cash equivalents and short term investments totaled $44.5 million. Stockholders’ equity totaled $105.5 million. There was no debt.

“The fiscal second quarter reflected another quarter of improved operating results, excluding unusually high proxy related costs and a one-time payment to a former officer to settle litigation and the related legal costs,” said Barry Weiner, President. “Margin improvement reflected a more favorable mix of products at Enzo Life Sciences and a higher percentage of esoteric testing at Enzo Clinical Labs.”

Second Quarter Sector Analysis

Enzo Life Sciences posted an 11% increase in total revenue, to $12.6 million for the quarter, including a 13% increase in product sales, offset by a slight decline in royalty and license income to $1.8 million. Product revenue increased due to increased products sales, driven by organic growth and the acquisition of Assay Designs, Inc. (ADI) in March 2009, partially offset by reduced low margin third-party distribution business. Gross margin improved to 58%, from 42% a year ago. Gross margin improved due to a 19% decline in the cost of product sales, primarily resulting from elimination of the aforementioned lower-margin distribution business. Selling, general and administrative expenses increased as a percentage of total revenue to 40%, from 26%, primarily reflecting costs this year associated with ADI, which were not incurred a year ago prior to the acquisition. Operating income increased to $0.4 million, from $0.1 million the year before.

Enzo Clinical Labs posted an 11% increase in revenues, to $10.6 million, due largely to higher service volume. Higher reagent costs and personnel expenses, due to additions to the marketing and professional staff in anticipation of expanding service territories and test offerings, were reflected in greater laboratory costs and selling, general and administrative expenses. However, with the new billing system, the provision for uncollectible receivables declined to $0.5 million, from $1.4 million, resulting in a reduced operating loss of ($2.0) million, compared to a year-ago operating loss of ($2.3) million.

Enzo, as previously announced, has obtained exclusive rights from GeneNews Limited, of Toronto, Canada, to market its ColonSentry™, a proprietary blood test for colorectal cancer screening. . This division also has entered into an exclusive marketing partnership with privately-owned Ikonisys, Inc., of New Haven, CT, relating to Ikonisys’ proprietary oncoFish® cervical test, a molecular diagnostic tool for cancer detection. Enzo will make the test available to medical practitioners requesting advanced analysis of specimens from routine tests that are not definitive as to the existence of cervical cancer.

First Half Results

Results for the first six months of fiscal 2010 reflect solid improvement over year-ago results. Total revenue increased 15%, to $48.4 million and, despite the litigation settlement and related legal costs of $3.7 million and incremental proxy related costs of $0.7 million, the net loss fell to ($12.1) million, or ($0.32) per share, compared to the year-ago net loss of ($14.0) million, of ($0.38) per share, a decline of 14% or an improvement of $1.9 million. Gross profit advanced 49%, to $24.2 million, and gross margin advanced to 50%, from 39% in the year ago period.

“The acquisitions and investments we have made over the past several years at Enzo Life Sciences contributed to the strong organic revenue growth, generating higher sales of proprietary products, coupled with the elimination of lower profit distribution business. Enzo Clinical Labs added experienced resources to its sales force, as well as benefiting from the new billing system that has reduced uncollectible receivables. It has also invested in facilities expansion to support our growing molecular diagnostic capabilities that increasingly is the wave of the future.”

Mr. Weiner added: “The recent favorable decision by the Patent Office relative to the interference action against Bayer Diagnostics, now owned by Siemens, presents Enzo with an opportunity to capitalize on our pending patent application which if issued, would have a 17 year life and could confer promising broad technological applications to add to our intellectual property estate. We also expect the proof of concept clinical study to begin shortly for Optiquel™, our oral, proprietary treatment for chronic autoimmune uveitis, being conducted in cooperation with the National Eye Institute, part of the National Institute of Health.”

Conference Call

The Company will conduct a conference call on March 15, 2010 at 8:30 AM EDT. The call can be accessed by dialing 1-888-459-5609. International callers can dial 1-973-321-1024. Please reference PIN number 61758421. Interested parties may also listen over the Internet at http://www.wsw.com/webcast/cc/enz5/. To listen to the live call on the Internet, please go to the web site at least fifteen minutes early to register, download and install any necessary audio software. For those who cannot listen to the live broadcast, a replay will be available approximately two hours after the end of the live call, through midnight (ET) on March 25, 2010. The replay of the conference call can be accessed by dialing 1-800-642-1687, and when prompted, use PIN number 61758421. International callers can dial 1-706-645-9291, using the same PIN number.

NON-GAAP Financial Measures

To comply with Regulation G promulgated pursuant to the Sarbanes-Oxley Act, Enzo Biochem attached to this news release and will post to the Company's investor relations web site (www.enzo.com) any reconciliation of differences between non-GAAP financial information that may be required in connection with issuing the Company's quarterly financial results.

The Company uses EBITDA, as a measure of performance to demonstrate earnings exclusive of interest, taxes, depreciation and amortization. A further adjustment to the EBITDA was shown in this press release to reflect the litigation settlement to a former officer and the related legal costs. The Company manages its business based on its operating cash flows. The Company, in its daily management of its business affairs and analysis of its monthly, quarterly and annual performance, makes its decisions based on cash flows, not on the amortization of assets obtained through historical activities. The Company, in managing its current and future affairs, cannot affect the amortization of the intangible assets to any material degree, and therefore uses EBITDA as its primary management guide. Since an outside investor may base its evaluation of the Company's performance based on the Company's net loss not its cash flows, there is a limitation to the EBITDA measurement. EBITDA is not, and should not be considered, an alternative to net loss, loss from operations, or any other measure for determining operating performance of liquidity, as determined under accounting principles generally accepted in the United States (GAAP). The most directly comparable GAAP reference in the Company's case is the removal of interest, taxes, depreciation and amortization.

About Enzo Biochem

Enzo Biochem, Inc., is a growth-oriented integrated life sciences and biotechnology company focused on harnessing biological process to develop research tools, diagnostics and therapeutics, and serves as a provider of test services, including exotic tests, to the medical community. Since our founding in 1976, our strategic focus has been on the development of enabling technologies in the life sciences field. Enzo Life Sciences develops, produces and markets proprietary labeling and detection products for gene sequencing, genetic analysis and immunological research, among others. Its catalog of over 40,000 products serve the molecular biology, drug discovery and pathology research markets worldwide. Enzo Clinical Labs provides laboratory services for a growing roster of physicians in the New York Metropolitan area, as well as parts of New Jersey and Pennsylvania. Its tests include, in addition to routine tests, capabilities for detecting molecular infection disease, molecular oncology, autoimmune disorders and genetics. Enzo Clinical Labs also provides clinical diagnostic services that allow Enzo to capitalize on its extensive advanced molecular and cytogenetic capabilities and the broader trends in predictive and personalized diagnostics. Enzo Therapeutics is a biopharmaceutical venture that has developed multiple novel approaches in the areas of gastrointestinal, infectious, ophthalmic and metabolic diseases. It has focused its efforts on developing treatment regimens for diseases and conditions for which current treatment options are ineffective, costly, and/or cause unwanted side effects. In the course of the company’s research and development activities, Enzo has developed a substantial portfolio of intellectual property assets, with 249 issued patents worldwide and over 200 pending patent applications.

Except for historical information, the matters discussed in this news release may be considered "forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include declarations regarding the intent, belief or current expectations of the Company and its management. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties that could materially affect actual results. The Company disclaims any obligations to update any forward-looking statement as a result of developments occurring after the date of this press release.

###

Contact:

For: Enzo Biochem, Inc.

Steven Anreder, 212-532-3232 or Michael Wachs, CEOcast, Inc., 212-732-4300